“`html

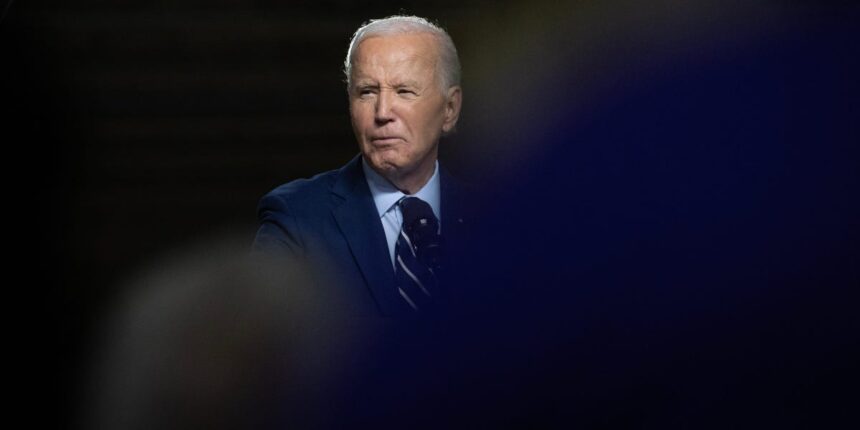

Scott Olson/Getty Images

- Oral arguments for Biden’s SAVE student loan repayment plan will be presented in a Missouri court on October 24.

- The implementation of the SAVE plan has been stalled for several months due to lawsuits from Republican state attorneys general.

- The case is currently with the 8th Circuit Court, which has been urged by the Supreme Court to expedite its decision-making process.

Millions of borrowers are nearing a pivotal court ruling that could lead to reduced payments and potential debt relief.

Last summer, President Biden and his Education Department unveiled the SAVE income-driven repayment strategy aimed at easing financial burdens for borrowers while shortening their path toward student loan forgiveness. This initiative was designed to provide more affordable payment options and quicker forgiveness timelines for eligible individuals.

However, shortly after key components of this plan were put into action—such as offering forgiveness for those with original balances of $12,000 or less who had made just ten years of qualifying payments—the initiative faced significant legal opposition. This culminated in two lawsuits spearheaded by GOP state attorneys general, resulting in a halt on any future loan forgiveness under this program as early as June.

The entire SAVE plan remains suspended; the 8th Circuit Court of Appeals issued an injunction preventing any actions related to it until a final ruling on its legality is reached. Consequently, approximately eight million borrowers enrolled in this program find themselves uncertain about their financial futures.

Current Status of Borrowers Amidst Legal Challenges

Given the complexity surrounding the ongoing litigation over the SAVE plan, confusion among borrowers is understandable. Numerous court decisions have influenced various aspects of this initiative over recent months. Presently, all eyes are on the 8th Circuit Court as it deliberates whether to uphold or dismiss the entire proposal following its preliminary injunction against it.

In late August, the Supreme Court opted not to permit further implementation efforts by the Education Department while legal proceedings continued and redirected responsibility back to the 8th Circuit. In its brief statement, America’s highest court expressed confidence that “the 8th Circuit will render its decision with appropriate dispatch,” urging prompt resolution from that body regarding this matter.

The timeline for when a definitive ruling will emerge remains unclear; however, it’s possible that insights from previous Supreme Court decisions may inform how judges approach their final verdicts concerning SAVE. Legal experts suggest that many arguments presented by GOP attorneys general—especially those relating to Mohela—are largely speculative at best.

An example highlighting these speculations comes from Federal Student Aid’s announcement earlier this year indicating that over one million student-loan accounts were being transitioned away from Mohela at Mohela’s request so borrowers could receive improved service quality. Experts like David Nahmias argue there’s no substantial evidence indicating financial detriment suffered by Mohela despite managing fewer accounts than before:

“Mohela has been offloading borrower accounts without showing signs of financial distress,” Nahmias stated during an interview with Business Insider.”

No immediate response was received from Mohela regarding inquiries about ongoing litigation matters raised against them.

Despite current blockages facing save initiatives within education policy frameworks today—the Education Department continues providing interest-free forbearance options while vowing commitment towards defending these plans legally moving forward.

Nonetheless,Nahmias emphasizes how such unpredictable shifts create chaos among affected individuals:

“People cannot make informed choices about monthly payment amounts due because they lack clarity around what lies ahead.”

Source

“`