Decline in Asian Stock Markets Led by Underperforming Semiconductor Sector

Asian stock markets are experiencing downturns, particularly with semiconductor companies lagging behind. This trend reflects broader concerns impacting the region’s economic landscape.

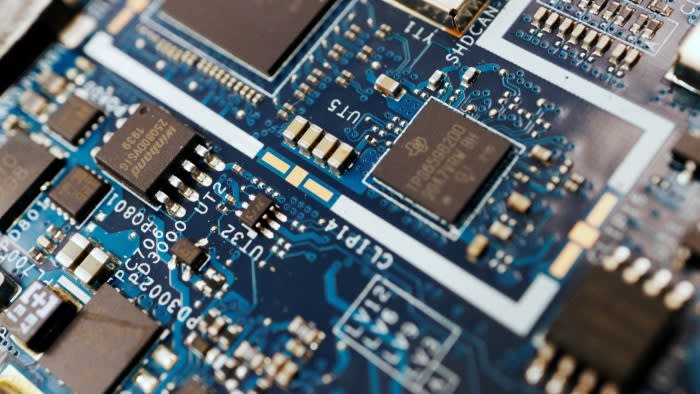

Semiconductor Sector Faces Challenges

Recent reports indicate that semiconductor stocks are struggling amid fluctuating demand and global supply chain issues. As major manufacturers adjust their production strategies to combat rising operational costs, investors are expressing caution. Industry experts predict that unless there is a significant resurgence in demand, the outlook for chipmakers remains bleak.

Economic Factors at Play

Several macroeconomic elements contribute to this diminished performance. Rising interest rates globally have led to heightened borrowing costs and dampened consumer spending. Additionally, geopolitical tensions can disrupt supply chains further impacting stock valuations across Asia.

Current Market Conditions

As of October 2023, major Asian indices have shown signs of vulnerability due to these pressing conditions. For instance, countries like South Korea and Taiwan—home to leading semiconductor firms—have reported lower stock prices as investors reconsider risks associated with tech stocks.

Implications for Future Investments

Analysts suggest a careful approach moving forward for those interested in investing within the semiconductor domain. Companies may need to innovate or diversify their offerings to stabilize revenues amid ongoing challenges.

while Asian equities face downward pressure from various economic factors, particularly within the semiconductor sector, it is crucial for investors and stakeholders alike to stay informed about market developments as they navigate these turbulent waters.